About Me

In recent times, the monetary landscape has witnessed a growing interest in valuable metals as a viable investment possibility. With financial uncertainty and inflation issues looming large, many traders are turning to precious metals like gold, silver, platinum, and palladium as a method to diversify their portfolios and safeguard their assets. One among the simplest methods to invest in these metals is through a Precious Metals Individual Retirement Account (IRA). This article explores the best Precious Metals IRA choices available at this time, helping you make informed choices to safe your monetary future.

Understanding Treasured Metals IRAs

A Precious Metals IRA is a self-directed retirement account that allows traders to hold bodily precious metals as part of their retirement portfolio. Unlike traditional IRAs, which sometimes embrace stocks, bonds, and mutual funds, a Precious Metals IRA affords the unique advantage of tangible assets. Any such IRA will help protect towards inflation and market volatility, making it a popular alternative among savvy buyers.

To establish a Precious Metals IRA, traders must first set up a self-directed IRA with a custodian that specializes in treasured metals. If you loved this article and you would like to get a lot more info about investment security with gold ira kindly pay a visit to the site. The custodian is chargeable for managing the account and guaranteeing compliance with IRS laws. Once the account is established, buyers can fund it by means of contributions or rollovers from present retirement accounts.

Why Invest in Treasured Metals?

Investing in valuable metals presents several benefits:

- Hedge In opposition to Inflation: Valuable metals, significantly gold, have historically served as a hedge against inflation. When the worth of fiat forex declines, the value of precious metals tends to rise.

- Diversification: Together with precious metals in your investment portfolio will help diversify your belongings, decreasing general danger.

- Tangible Belongings: Not like stocks and bonds, treasured metals are bodily property that you could hold and retailer, offering a sense of security.

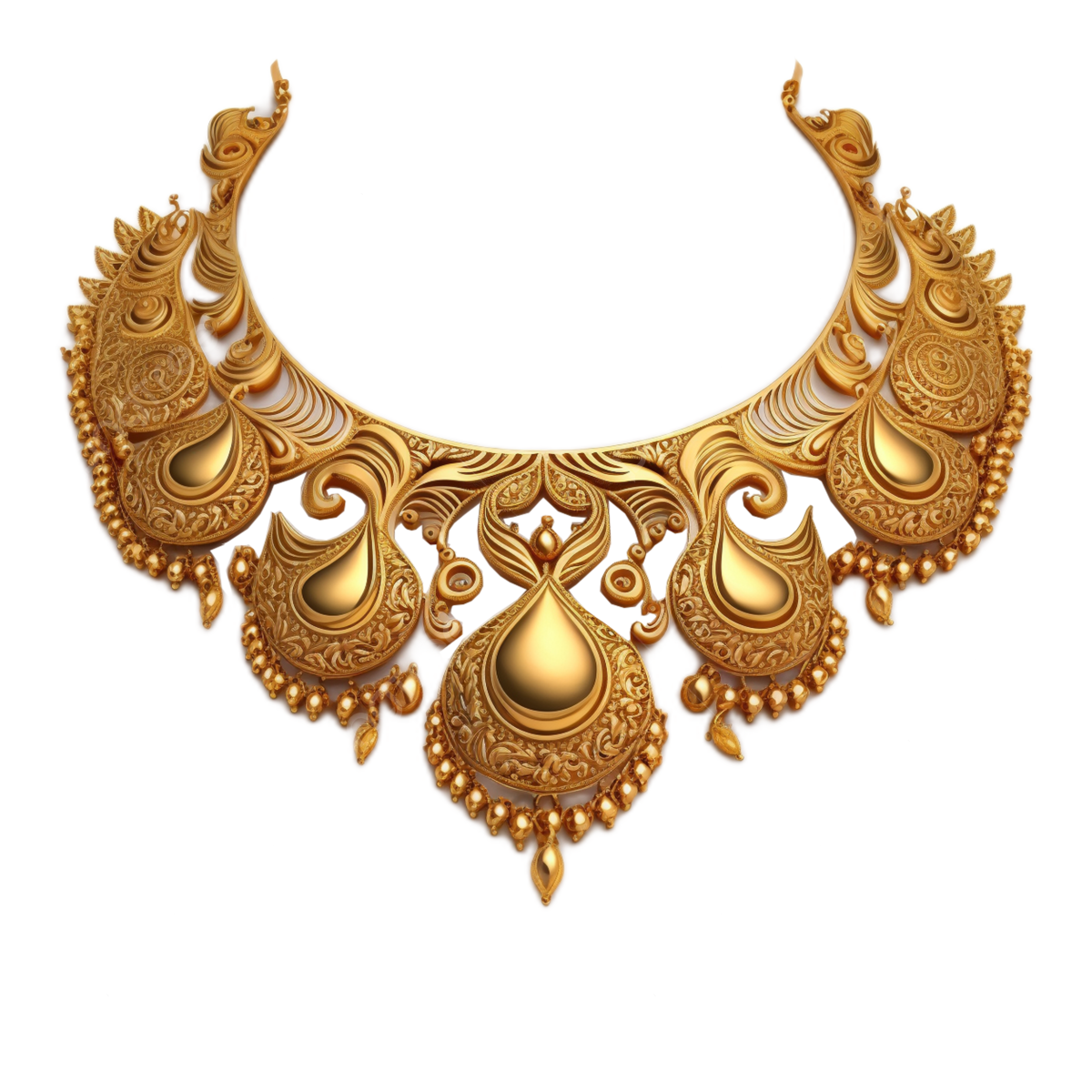

- World Demand: Valuable metals are in demand worldwide for various applications, together with jewelry, electronics, and industrial uses, making certain their intrinsic worth.

Choosing the Best Precious Metals IRA

When choosing the best Precious Metals IRA provider, several components ought to be considered:

- Repute and Trustworthiness: Look for a company with a strong popularity and positive buyer opinions. Test their rankings with organizations like the higher Enterprise Bureau (BBB) and Trustpilot.

- Charges and Costs: Perceive the fees related to organising and sustaining the IRA. This includes account setup fees, storage fees, and transaction charges. Examine different providers to search out probably the most cost-effective option.

- Choice of Precious Metals: Be sure that the IRA provider provides a variety of treasured metals, including gold, silver, platinum, and palladium. Examine if they supply IRS-accredited bullion and coins.

- Storage Options: Valuable metals have to be stored in an permitted depository to comply with IRS rules. Confirm the storage choices available, together with safety measures and insurance.

- Buyer Help: Select a provider that gives excellent customer service. They should be available to answer your questions and guide you through the funding process.

Prime Precious Metals IRA Suppliers

- Noble Gold: Noble Gold has gained a status for its exceptional customer service and academic resources. They offer a large number of IRS-authorized precious metals and supply safe storage choices. Their transparent fee construction and dedication to serving to clients understand the investment course of make them a top selection for buyers.

- Goldco: Goldco is one other extremely regarded supplier in the Precious Metals IRA house. They focus on gold and silver IRAs and have a powerful track file of buyer satisfaction. Goldco gives a wealth of instructional supplies and customized providers to assist investors make knowledgeable decisions. Their competitive pricing and low fees further improve their attraction.

- Birch Gold Group: Birch Gold Group is understood for its extensive experience within the valuable metals market. They provide a wide range of investment choices, together with gold, silver, platinum, and palladium. Birch Gold Group provides customized consultations to help clients determine the most effective funding technique for their needs. Their dedication to transparency and customer training sets them aside from rivals.

- American Hartford Gold: American Hartford Gold is a household-owned company that focuses on providing distinctive service and a wide range of precious metals. They offer aggressive pricing and a easy price structure. Their educated group is devoted to helping purchasers navigate the complexities of Valuable Metals IRAs and make knowledgeable investment choices.

- Regal Property: Regal Property is a number one supplier of alternative property, including treasured metals. They offer a streamlined process for establishing a Precious Metals IRA and provide a various number of IRS-authorised bullion and coins. Regal Assets is known for its dedication to safety and customer satisfaction, making it a reliable selection for investors.

The Process of Setting up a Precious Metals IRA

Setting up a Precious Metals IRA involves a number of steps:

- Choose a Custodian: Analysis and select a good custodian that focuses on Valuable Metals IRAs.

- Open an Account: Full the mandatory paperwork to open your self-directed IRA.

- Fund the Account: You'll be able to fund your new IRA by means of contributions or rollovers from present retirement accounts.

- Select Your Precious Metals: Work along with your custodian to choose the valuable metals you wish to invest in, making certain they meet IRS rules.

- Storage Arrangement: Arrange for safe storage of your precious metals by way of an permitted depository.

- Monitor Your Investment: Usually review your Precious Metals IRA to make sure it aligns along with your monetary objectives and market conditions.

Conclusion

Investing in a Precious Metals IRA may be a smart strategy for diversifying your retirement portfolio and protecting your wealth against economic uncertainties. By carefully selecting a reputable provider and understanding the ins and outs of precious metals investing, you'll be able to safe your financial future. As always, it's advisable to seek the advice of with a financial advisor to tailor your investment strategy to your individual wants and circumstances. With the proper method, a Precious Metals IRA generally is a priceless addition to your retirement planning toolkit.

Location

Occupation